How to Calculate Dividend Per Share

How to Calculate Expected Return of a Stock. It is usually used as a measure to price the stocks such that stocks with higher EPS attract higher prices.

Dividend Definition And Examples Of Dividend Stocks

Some of the advantages of earnings per share are.

. They pay a 2 billion dividend to shareholders over the course of the year and they have 4 billion shares outstanding. For example if a company is expected to generate free cash flow of 100 per year in the future using a 12 percent discount rate cash flow is capitalized by dividing it by the capitalization rate. Weighted earnings per share.

Dividend per share DPS is the total dividends paid. And while there are many ways of estimating the cost of equity for example by using the Capital Asset Pricing Model CAPM it can also be proxied by the dividend yield. Suppose Wacken Limited just issued a dividend of 273 per share on its common stock.

Company A has historically paid out 45 of its earnings as dividends. In this article you will learn how to calculate earnings per share types of earnings per share and why knowing it is important for your investments. Read more and Price per Share.

B has not paid 2 on the paid-up value of 10. PE ratio X Earnings per Share Equals Stocks intrinsic value. First Quarter Fiscal Year 2023 Results Summary.

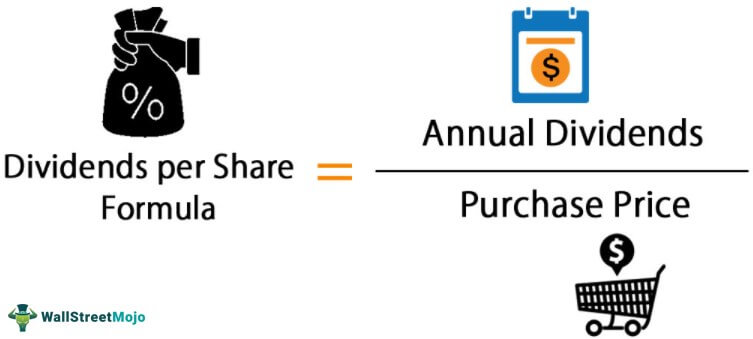

You need to provide the two inputs of Dividend per Share Dividend Per Share Dividends per share are calculated by dividing the total amount of dividends paid out by the company over a year by the total number of average shares held. Net income amounted to 248 million or 062 per diluted share for the three months ended June 30 2022 compared to 59 million or 014 per. Growing businesses have a greater PE ratio but established businesses have a lower rate of PE growth.

Reality Income pays a dividend of 283 per share. If the stock currently sells for 43 what is your best estimate of the companys cost of equity capital using the arithmetic average growth rate in dividends. Calculate dividend yield total income per month quarterly or yearly based on the number of shares you own and total cost to acquire this yield.

A company uses this calculation to. B will not receive a. Which includes income from both equity and dividend growth.

Find your companys dividends per share or DPS value. Business analysts use a variety of techniques to determine a companys intrinsic worth. To calculate the ERR you first add 1 to the decimal equivalent.

The company paid dividends of 231 239 248 and 258 per share in the last four years. Dividend yield 350 50. Dividend per share DPS is the sum of declared dividends issued by a company for every ordinary share outstanding.

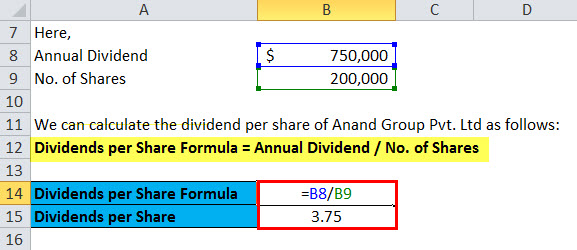

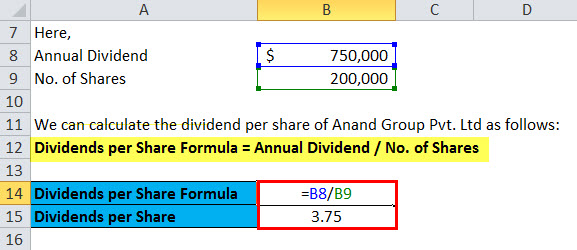

The term dividends per share DPS refers to the total dividend a company pays out over a 12-month period divided by the total number of outstanding shares. Dividend Per Share - DPS. Calculate expected rate of return given a stocks current dividend price per share and growth rate using this online stock investment calculator.

Calculation of Dividend Payable to Preference share capital 5000 shares 100 11. He will not pay the dividend on the calls in arrears. Mr has subscribed for 500 shares by paying 8 per share.

This may seem complicated however thats exactly why we created this stock dividend calculator. You can use this Earnings per Share EPS Calculator to calculate the earnings per share based on the total net income preferred dividends paid and the number of outstanding common shares. Many companies offer shares at a discount through their DRIP ranging from 3 to 5 percent.

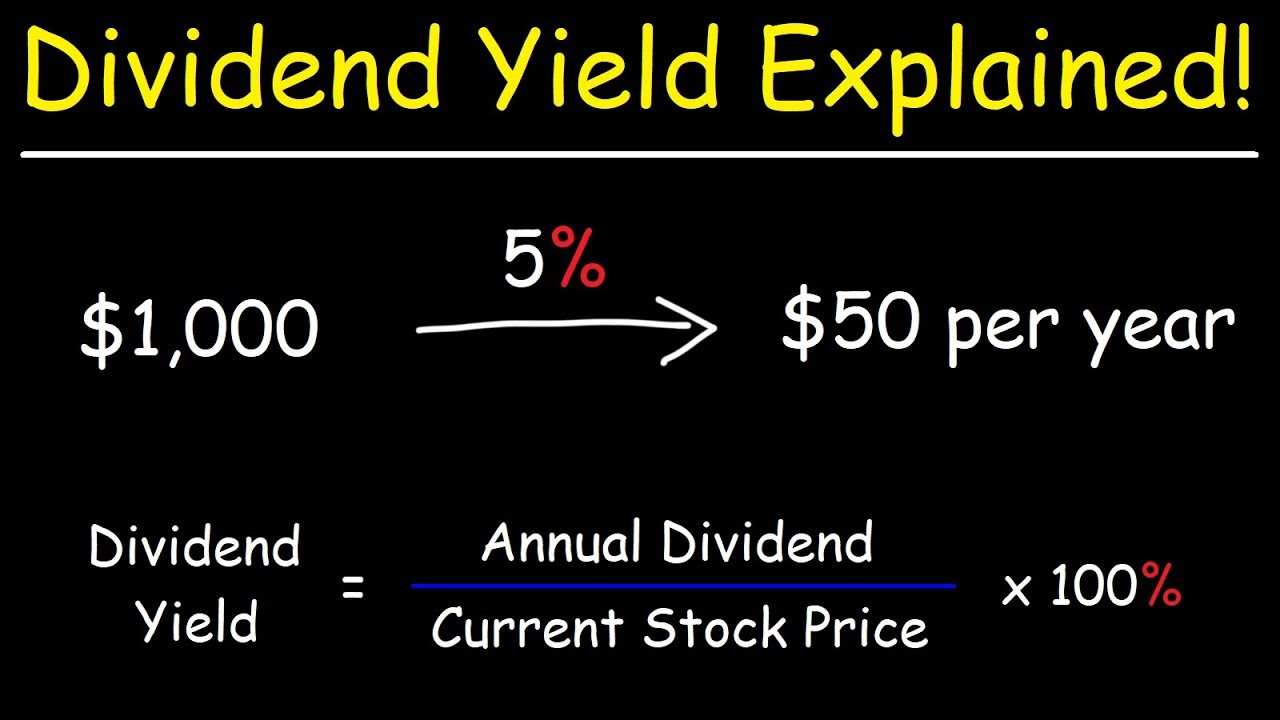

How to Calculate share value Example. The amount that will be additionally invested per year. First calculate dividend yield using the formula Dividend yield annual dividend stock price 100 If a share price is 50 and the annual dividend is 350 dividend yield is calculated using the formula.

First choose the currency you wish to use optional Next enter the total net income. Multiply the payout ratio by the net income per share to get the dividend per share Sample Dividend Per Share Calculation. And refers to the cost of equity.

It is very simple. Please calculate dividend payables. Currently there are 10 million shares issued with 3 million shares in the treasury.

Company A reported a net income of 10 million. To estimate the. Dividend Yield Annual Dividends Paid Per Share Price Per Share For example if a company paid out 5 in dividends per share and its shares currently cost 150 its dividend yield would be 333.

Refers to the dividend per share as above. Calculate Dividend Yield in Excel. For a given time period DPS can be calculated using the formula DPS D - SDS where D the amount of money paid in regular.

In order to calculate your weighted average price per share you can use the following formula. Advantages of Earnings Per Share. Therefore cash flow is converted into value by dividing 100 by 12 percent resulting in a value of 83333 10012 percent.

It captures the overall profit per share after paying off all the liabilities such as interest on the debt the dividend for preference shareholders etc. Estimate the dividend and growth yield of your investment with a few clicks. No matter what the Contribution Every value is this amount should represent the total annual contribution amount.

In words this means that you multiply each price you paid by the number of shares you bought at. This represents the amount of dividend money that investors are awarded for each share of company stock they own. Monthly dividend calculator dividend calculator monthly dividend income calculator monthly dividend yield calculator quarterly.

Follow the next steps to determine the earnings per share. Determine the dividends paid per share of company stock.

The Dividend Yield Basic Overview Youtube

Dividends Per Share Dps Formula And Calculator Excel Template

Dividends Per Share Formula Calculator Excel Template

Dividends Per Share Formula Calculator Excel Template

Dividends Per Share Meaning Formula Calculate Dps

Dividend Per Share Business Tutor2u

0 Response to "How to Calculate Dividend Per Share"

Post a Comment